Taking a closer look at what 3% covers for a real estate down payment.

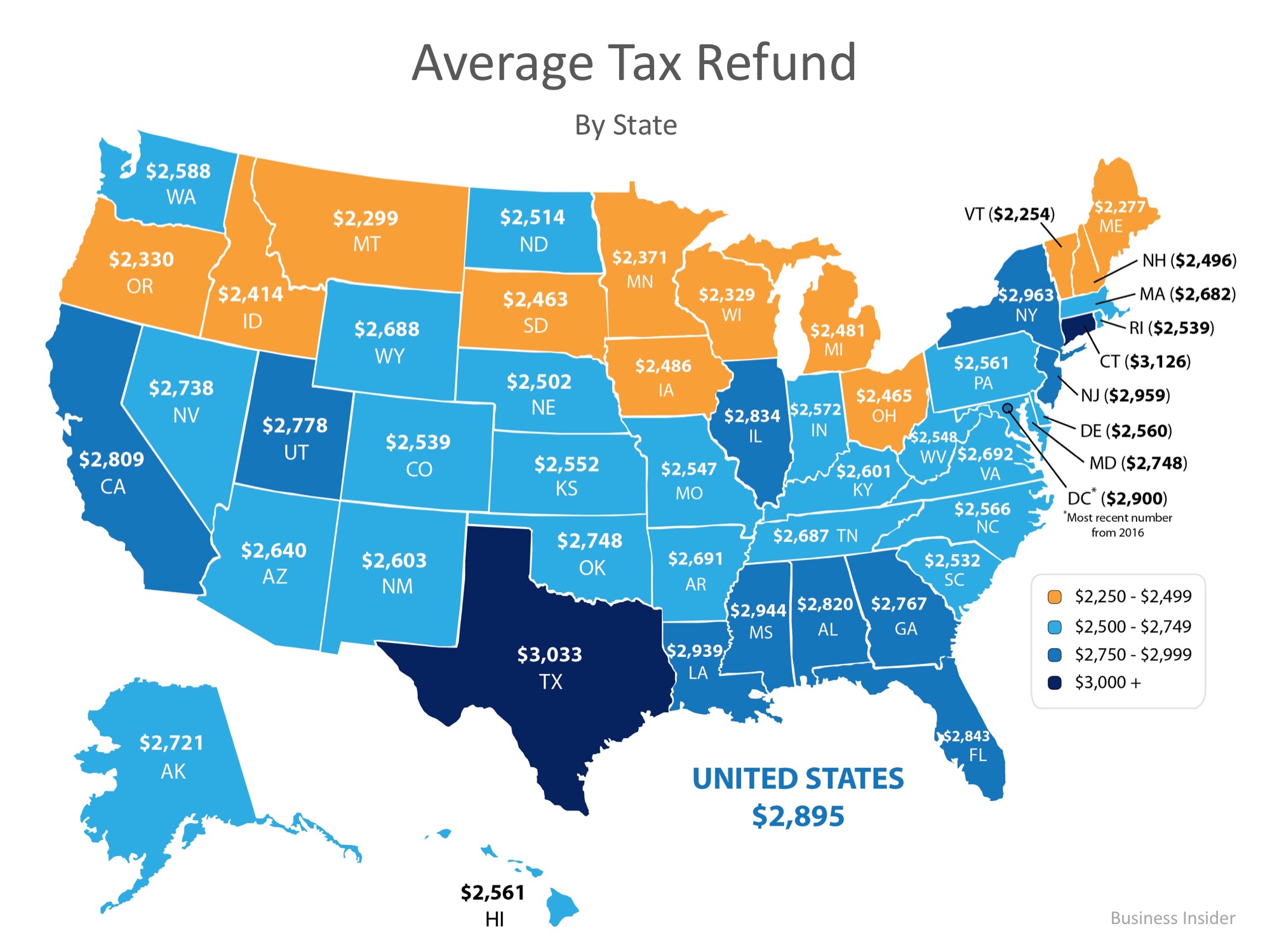

According to data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $2,840 this year when filing their taxes. This is down slightly from the average refund of $2,895, last year.

Tax refunds are often thought of as extra money that can be used toward larger goals; for anyone looking to buy a home in 2018, this can be a great jump start toward a down payment!

The map below shows the average tax refund Americans received last year by state. (The refunds received for the 2017 tax year should continue to reflect these numbers as the new tax code will go into effect for 2018 tax filings.)

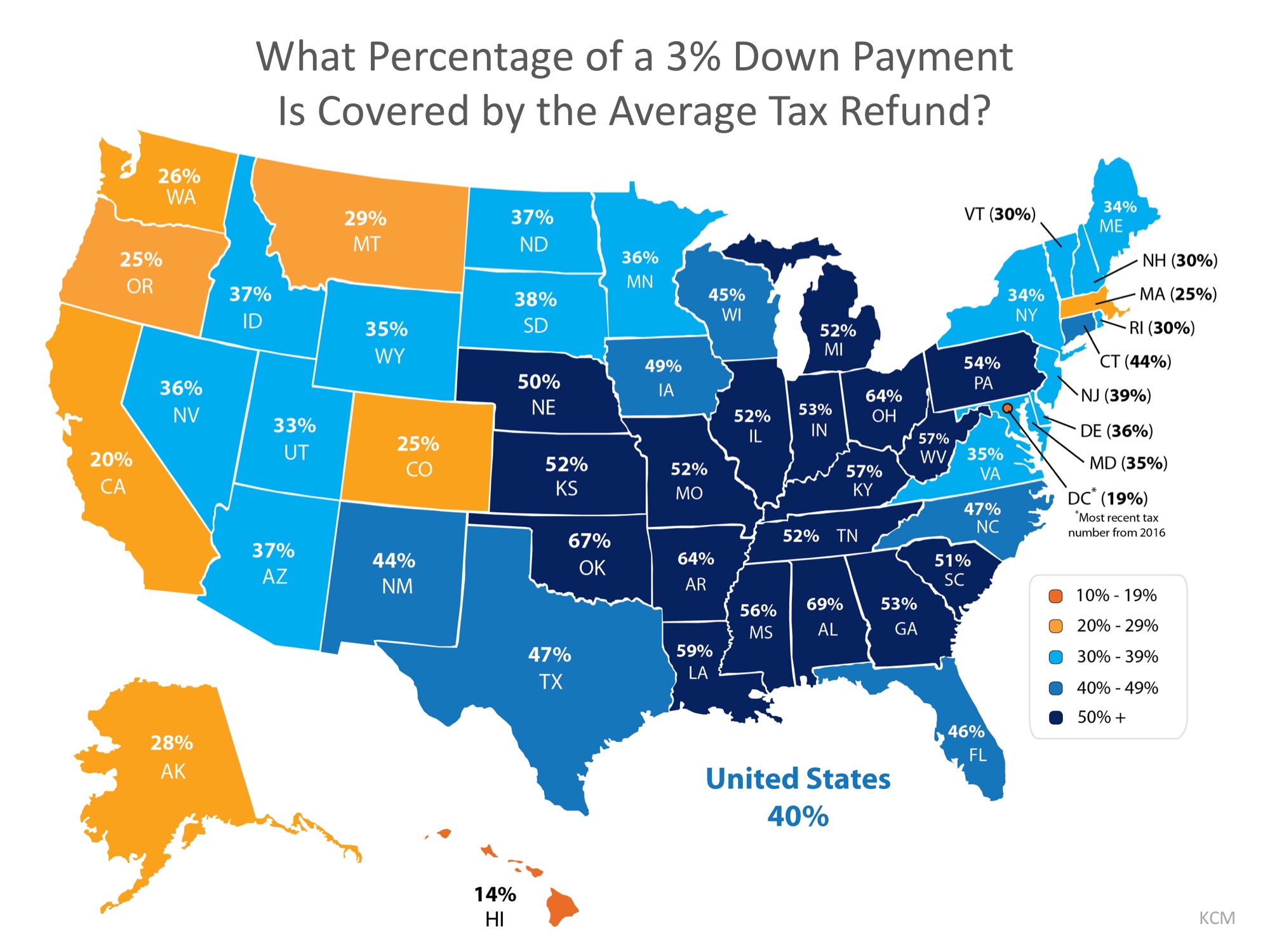

Many first-time buyers believe that a 20% down payment is required to qualify for a mortgage. Programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae all allow for down payments as low as 3%, with Veterans Affairs Loans allowing many veterans to purchase a home with 0% down.

If you started your down payment savings with your tax refund check this year, how close would you be to a 3% down payment?

The map below shows what percentage of a 3% down payment is covered by the average tax refund by taking into account the median price of homes sold by state.

The darker the blue, the closer your tax refund gets you to homeownership! For those in Alabama looking to purchase their first homes, their tax refund could potentially get them 69% closer to that dream!

Saving for a down payment can seem like a daunting task. But the more you know about whats required, the more prepared you can be to make the best decision for you and your family! This tax season, your refund could be your key to homeownership!

Now, when it comes to Seattle real estate…

You’ll definitely want a professional to guide you through our competitive Seattle real estate market if you’re considering selling your home, or buying a new one. Before you contact your Metropolist broker, download the latest details on trends, data and local stories in our Metropolist Magazine.

Go over it together, and do it soon!