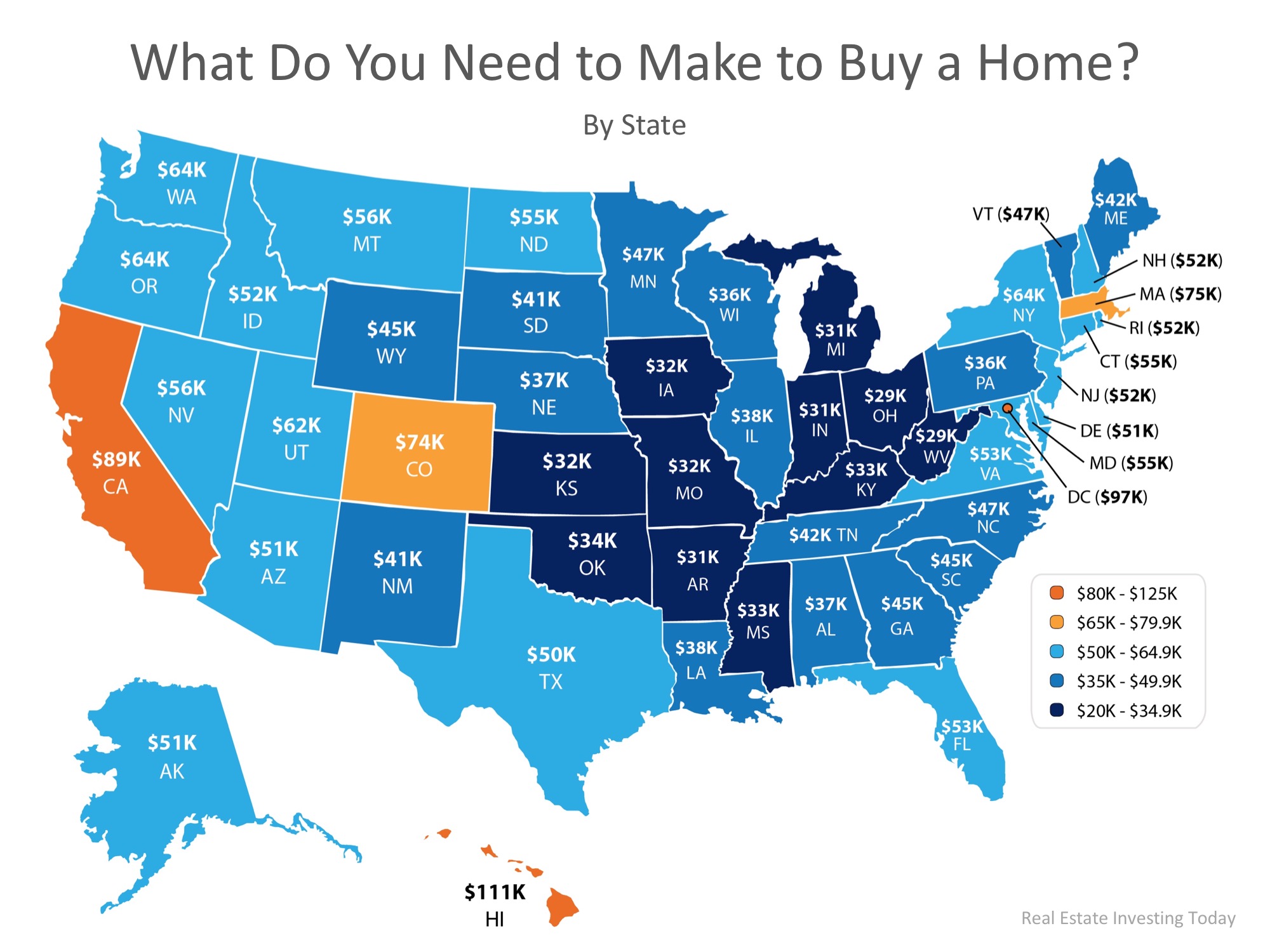

Review the map regarding minimum salaries needed for median-priced home investments.

Its no mystery that cost of living varies drastically depending on where you live. So, a new study by GOBankingRates set out to find out what minimum salary you would need to make in order to buy a median-priced home in each of the 50 states, and Washington, D.C.

States in the Midwest came out on top as most affordable, requiring the smallest salaries in order to buy a median-priced home.

States with large metropolitan areas saw a bump in the average salary needed to buy with California, Washington, D.C., and Hawaii edging out all others with the highest salaries required.

If you’re looking to buy a home in the beating heart of Seattle, you’ll want to check in with your trusted broker about a strategy to accomplish this. Note that the figure stated is for the state of Washington, vs. the city of Seattle on the map.

All 50

Below is a map with the full results of the study:

GoBankingRates gave this advice to anyone considering a home purchase,

Before you buy a home, its important to find out if you can afford the monthly mortgage payment. To do this, some financial experts recommend your housing costs primarily your mortgage payments shouldnt consume more than 30 percent of your monthly income.

As we recently reported, research from Zillow shows that historically, Americans had spent 21% of their income on owning a median-priced home. The latest data from the fourth quarter of 2017 shows that the percentage of income needed today is only 15.7%!

Bottom Line

If you are considering buying a home, whether its your first time or your fifth time, especially here in Seattle, you’ll want to get connected with your trusted Metropolist broker to evaluate your ability to do so in our competitive market.

Get connected with a real estate professional to navigate our market.