Home appreciation is in the forecast.

Here’s what that can mean for you as a homeowner.

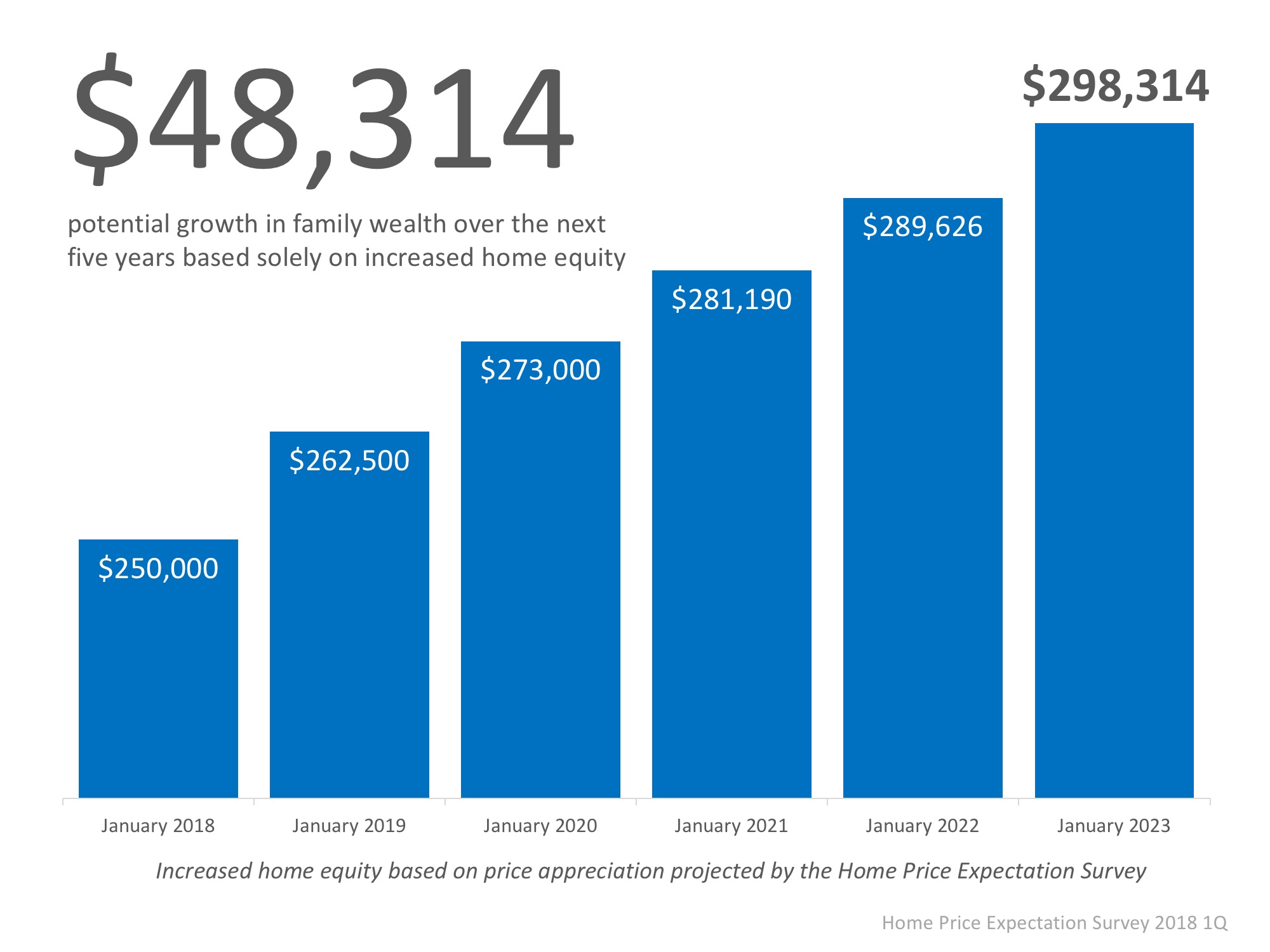

Over the next five years, home prices are expected to appreciate, on average, by 3.6% per year and to grow by 18.2% cumulatively, according to Pulsenomics most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, lets assume a young couple purchased and closed on a $250,000 home this January.

If we only look at the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 5.0% in 2018, the young homeowners will have gained $12,500 in equity in just one year.

Over a five-year period, their equity will increase by over $48,000!

This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a familys overall net worth.

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to do so today.

Concerned or confused about the terms “price” vs. “cost”? This post may help clarify.

Download your copy of the Metropolist Magazine today for more details about the state of the local Seattle real estate market.