Myth #1: The dreaded BUBBLE!

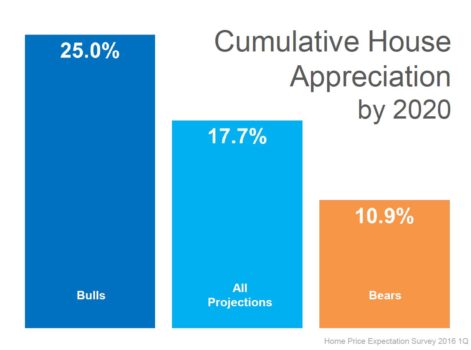

You are smart to be cautious in any market when making the biggest investment you are likely to make in your lifetime. But balance that with the bigger picture. The Seattle real estate market is growing and it can be tough for buyers. But a housing bubble is defined by unsustainable growth and unstable conditions in the marketplace. Between economic and population forecasts for Seattle being very strong and actual real estate price appreciation projections through 2020 being relatively modest (averaging between 2.74%-6.25% per year), things continue to look stable for our area. Forbes highlighted Seattle as one of the fastest growing cities with only a 3.7% growth rate and our friends over at KCM have compiled a nice list of about every top real estate economist weighing in on the idea of an impending meltdown. So things are getting more expensive to be sure, but if you are waiting for the market to come down before you buy, you are likely going to pay off your landlord’s mortgage.

You are smart to be cautious in any market when making the biggest investment you are likely to make in your lifetime. But balance that with the bigger picture. The Seattle real estate market is growing and it can be tough for buyers. But a housing bubble is defined by unsustainable growth and unstable conditions in the marketplace. Between economic and population forecasts for Seattle being very strong and actual real estate price appreciation projections through 2020 being relatively modest (averaging between 2.74%-6.25% per year), things continue to look stable for our area. Forbes highlighted Seattle as one of the fastest growing cities with only a 3.7% growth rate and our friends over at KCM have compiled a nice list of about every top real estate economist weighing in on the idea of an impending meltdown. So things are getting more expensive to be sure, but if you are waiting for the market to come down before you buy, you are likely going to pay off your landlord’s mortgage.

Myth #2: Mortgages are impossible to get these days!

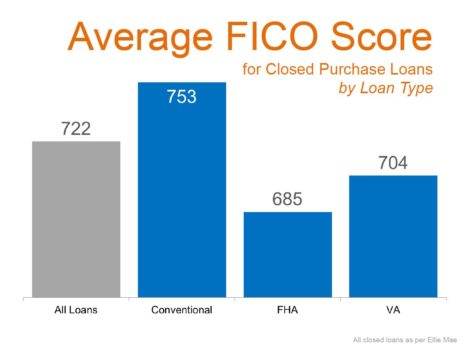

You may believe that you need to have a perfect credit score in order to qualify for a sizable loan but the average FICO score for loans are lower than you may expect. And there are great low down payment programs available so it takes less money than you think. Even if you aren’t ready to buy yet, it would smart to speak to a trusted mortgage lender to see where you stand. You may be closer than you think and if there is work to be done to get ready they will be able to advise you. Knowledge is power!

You may believe that you need to have a perfect credit score in order to qualify for a sizable loan but the average FICO score for loans are lower than you may expect. And there are great low down payment programs available so it takes less money than you think. Even if you aren’t ready to buy yet, it would smart to speak to a trusted mortgage lender to see where you stand. You may be closer than you think and if there is work to be done to get ready they will be able to advise you. Knowledge is power!

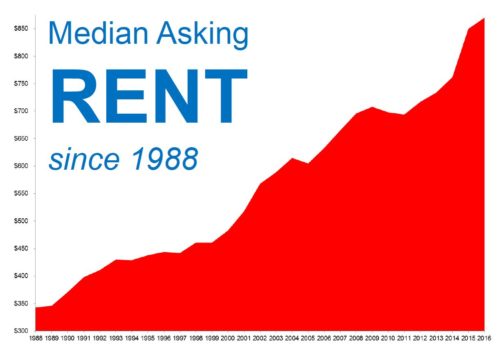

Myth #3: Renting is cheaper than buying in this crazy market!

The biggest myth of all is that renting a home is more affordable.

The biggest myth of all is that renting a home is more affordable.

If you have been paying any attention at all you know that rents have gone up significantly in Seattle. And when you rent, you don’t get any of the tax savings of owning. Take a look at the NY Times Rent vs Buy calculator to see whether you are better off renting… And give some thought to the vast difference in the average net worth of homeowners over renters. You might be surprised by how the numbers actually shake out.