A closer look at “price” vs. “cost”.

There is no doubt that the price of a home in most regions of the country is greater now than at any time in history.

However, when we look at the cost of a home, it is cheaper to own today than it has been historically.

The difference between “price” and “cost”

The price of a home is the dollar amount you and the seller agree to at the time of purchase. The cost of a home is the monthly expense you pay for your mortgage payment.

To accurately compare costs in different time periods, we must look at home prices, mortgage rates, and wages during each period. Home prices were less expensive years ago, but paychecks were also smaller and mortgage rates were much higher (the average mortgage interest rate in 1988 was 10.34%).

The best way to measure the COST of a home is to determine what percentage of income is necessary to buy a home at the time. That would take into account the price of the home, the mortgage interest rate and wages at the time.

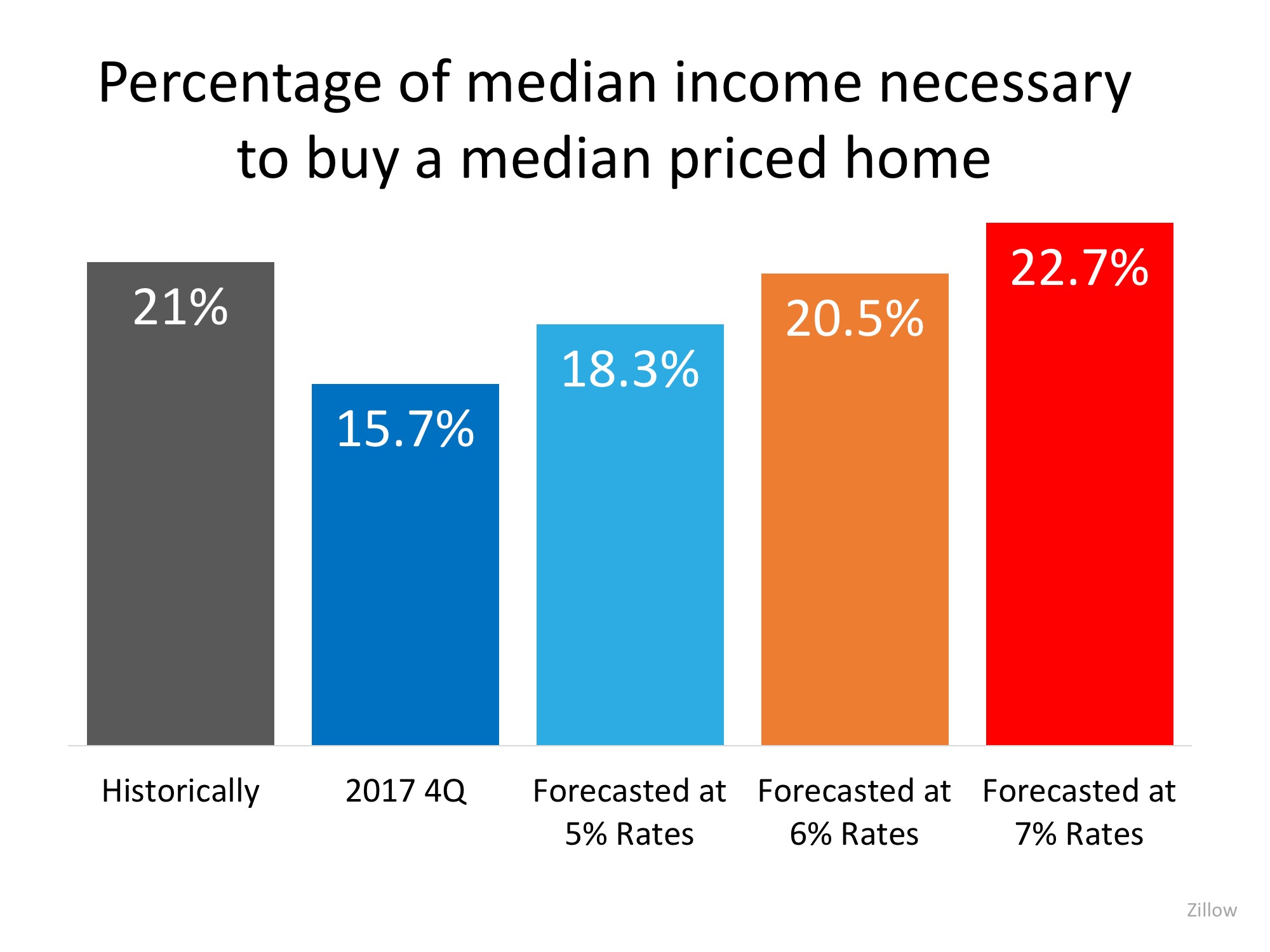

Zillow just released research that examined home costs using this formula. The research compares the historic percentage of income necessary to afford a mortgage to the percentage needed today. It also revealed the cost if mortgage rates continue to rise as experts are predicting. Here is a graph of their findings*:

Rates would need to jump to 7% in order for the percentage of necessary income to be greater than historic norms.

Moving forward

Whether you are a homeowner considering selling your current house and moving up to the home of your dreams, or a first-time buyer trying to purchase your first home, its a great time to move forward.

*Assumptions in the Zillow report: Buyer puts 20% down, takes out a conforming, 30-year fixed-rate mortgage at rates prevailing at the time, earns the median household income, and is buying a median-valued home.

But what about Seattle?

You probably have questions, and may even be a bit skeptical about the content shared above. Consider asking your trusted Metropolist broker about your specific best next steps to take in our competitive Seattle market.

What would be helpful to have a fantastic and efficient conversation?

It’s always great to make and bring a list of either goals or specific things you’d like to see happen or would like to have as part of the property investment. The more details about what you want to have, or have happen in the process, will make for a better conversation for everyone.