Once just isn’t enough.

We’re talking about 1. the prospective buyer and 2. the bank appraisal process.

In todays housing market, where supply is very low and demand is very high, home values are increasing rapidly.

You already know this. Especially here in the Seattle area.

What you may not know

Many experts are projecting that home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

Why?

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

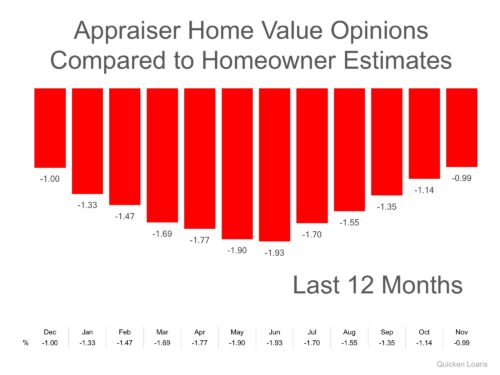

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth, and an appraisers evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in todays market to remember the impact of this challenge:

Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average like Denver, Seattle and San Francisco are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values arent rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom line: both buyer & bank

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the banks appraisal).

With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, it’s important to get started in talking about it sooner than later, and anticipate any other obstacles that may arise.

Get in touch with your Metropolist broker and get the process underway today!